By Diwakar Sinha

If you’re a founder leading an MSO or DSO, you already know 2026 is different. The market is opening, capital is flowing again, and buyers are leaning in with a level of conviction we haven’t seen in years. But there’s a truth most founders don’t fully appreciate until it’s too late:

A successful transaction in late 2026 doesn’t start in late 2026. It starts now.

Not because the market demands it, but because the process itself does.

The timeline for a well‑run recapitalization is not measured in weeks. It’s measured in months. Six to nine months for most platforms. Longer for scaled organizations. And every one of those months’ matters.

The founders who thrive in this cycle will be the ones who understand that timing is not a date on a calendar. Timing is preparation.

The Hidden Complexity Behind Every “Simple” Transaction

From the outside, a sale looks like a single event. From the inside, it is a sequence of interlocking decisions that must be made with precision:

- Aligning doctor‑partners and anchoring them for the transition

- Navigating complex legal structures with counsel

- Coordinating tax strategy with CPA teams

- Recasting financials with defensible accuracy

- Building a narrative that resonates with strategic and financial buyers

- Preparing for diligence long before diligence begins

None of these steps can be rushed. None of them can be skipped. And none of them can be solved reactively.

This is why founders who wait for “the right moment” often discover that the moment passed months earlier.

The Real Work Happens Before the Market Ever Sees You

A founder once told me, “I thought the process started when we went to market.” I told him the truth: that’s when the world sees the work, not when the work begins.

Before a buyer ever opens your data room, we’ve already:

- Diagnosed operational gaps

- Rebuilt financial clarity

- Structured partner alignment

- Forecasted growth pathways

- Anticipated legal and tax implications

- Identified risks buyers will surface

- Solved problems you haven’t encountered yet

This is the difference between a deal that closes smoothly and a deal that collapses under its own weight.

It’s why we say, “We need to have the answers to the questions our clients haven’t thought about.”

Because buyers will ask them. And they will expect you to be ready.

2026 Is the Window; But Windows Have Edges

The market is giving founders a rare alignment:

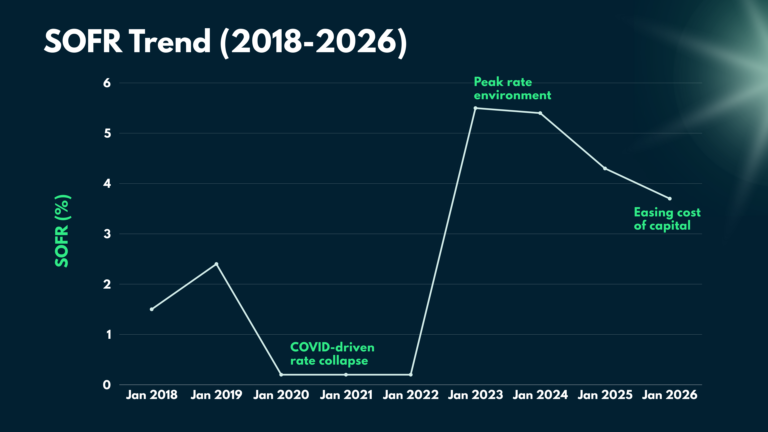

- SOFR easing

- Valuations strengthening

- Strategics repositioning

- Family offices leaning in

- Founder‑led platforms commanding premiums

But here’s the part no one talks about:

The founders who capture the best outcomes in Q3 and Q4 of 2026 are the ones who begin the process in early 2026.

Not because of urgency. Because of reality.

The work required to prepare a platform; truly prepare it, cannot be compressed without sacrificing value, structure, or control.

And in a year where buyers are selective and disciplined, preparation is the difference between being chosen and being overlooked.

The Advantage Belongs to the Prepared

Founders who start early will:

- Control their narrative

- Shape their buyer universe

- Protect their culture

- Anchor their doctor‑partners

- Optimize tax outcomes

- Strengthen deal structure

- Maximize valuation

- Move through diligence with confidence

Founders who wait will face a different experience entirely. Not because their business is weaker, but because the process is unforgiving.

The Moment Is Here. The Work Begins Now.

2026 is the year founders have been waiting for. But the founders who succeed in this cycle won’t be the ones who simply show up.

They’ll be the ones who prepared early, planned intentionally, and partnered with a team capable of seeing around corners.

A team that understands the operational, financial, legal, tax, and human dimensions of a transaction. A team that can architect the process, forecast the obstacles, and solve problems before they ever reach your desk.

A team that already has the answers to the questions you haven’t thought about.

The window is open. The opportunity is real. And the platforms that begin the journey now will be the ones that finish it on their terms.