By Diwakar Sinha

In the world of medical service organizations (MSOs) and dental service organizations (DSOs), recapitalization strategies are deeply tied to capital market conditions. While many factors influence M&A activity, including credit leverage ratios, buying patterns, same-store improvements, and deal structures, one market indicator stands out for its clarity: the Secured Overnight Financing Rate (SOFR).

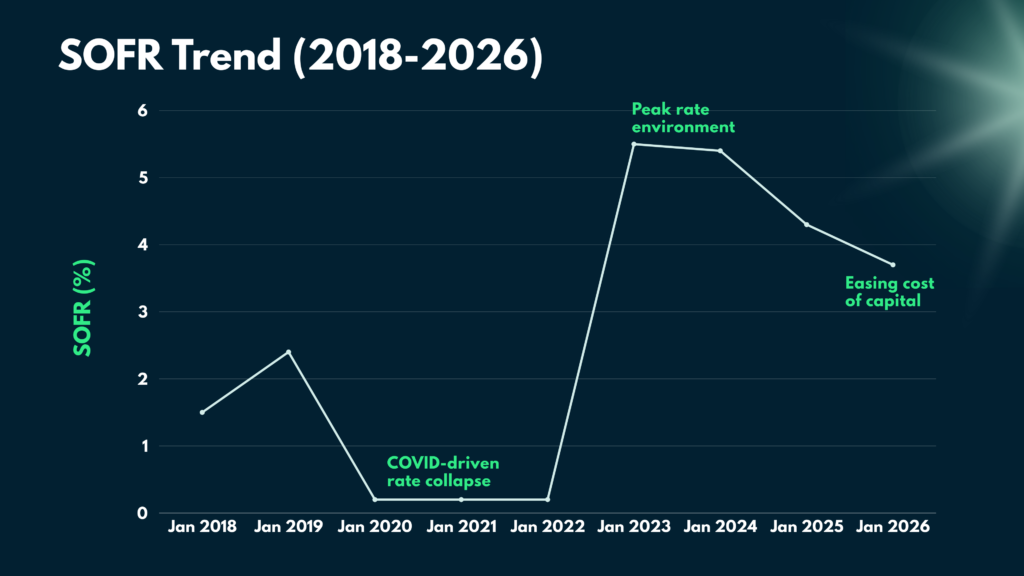

SOFR is a benchmark interest rate that directly impacts the cost of borrowed capital used to finance acquisitions. By focusing on SOFR, we can trace how the cost of capital has shaped recapitalization cycles, valuations, and ultimately the pace of M&A from 2018 through today.

Pre-COVID Conditions: SOFR as a Signal

- Dec 17, 2018: 2.35%

- Dec 16, 2019: 1.55%

- Mar 30, 2020: 0.01%

These three data points tell a clear story. In the two years leading up to COVID, SOFR was already trending downward, lowering the cost of capital and creating favorable pricing conditions for M&A. Even before the pandemic, capital was becoming cheaper, setting the stage for aggressive deal-making.

In simple terms: when borrowing costs fall, buyers can pay more, and they often do.

COVID Era: Unprecedented Deployment of Capital

From March 2020 through early 2022, SOFR hovered near zero (approximately 0.05%). This effectively meant extremely low borrowing costs.

During this period:

- Sponsors and strategics deployed capital at an unprecedented rate

- Premium valuations were paid for MSOs and DSOs

- Middle-market transactions flourished as the cost of capital was negligible

This environment fueled rapid consolidation and expansion, with Strategics & Private Equity deploying capital often exceeding $50M-$150M+. Cheap capital accelerated growth, rewarded scale, and compressed timelines for expansion.

Post-COVID Reality: Rising SOFR and Cashflow Compression

The tide turned quickly. By July 31, 2023, SOFR reached 5.30%, holding near that level through late 2024.

For firms with debt tied to SOFR plus an additional 300-500+ basis points, this translated into:

- Significant cashflow compression as interest expense increased

- Pressure to deliver operational improvements or reduce costs

- Increased risk of lender defaults

- Failed sale processes as valuations fell short of expectations

The recapitalization environment became far more challenging, and many strategics struggled to realize the value they had anticipated during the low-rate era.

Early Signs of a Market Turn

Since early 2025, Polaris has consistently signaled that market conditions were beginning to shift, and the data is now validating that view:

- Jan 6, 2025: 4.29%

- Dec 15, 2025: 3.75%

That represents a 1.55% decline from peak levels, easing the cost of capital and improving the economics of recapitalization and M&A.

For founders, this matters because lower borrowing costs generally support stronger valuations, healthier deal structures, and more active buyer demand.

Looking Ahead: 2026 as a Robust M&A Year

All indicators point to 2026 as a robust year for recapitalization and M&A in the MSO and DSO space. Lower SOFR levels, combined with pent-up demand and strategic repositioning, suggest that a meaningful increase in activity is coming.

2026 is the year.

Preparing Your Business for Sale in a Shifting Market

This chart makes the SOFR trajectory unmistakable: from near-zero rates fueling aggressive M&A, to peak compression in 2023-2024, and now easing into what looks like a promising 2026.

As capital markets ease and M&A activity accelerates, the businesses that achieve maximum value are those that prepare well in advance. Recapitalization is not just about timing. It’s about readiness.

Key steps to consider:

- Financial discipline: Clean, audited financials and transparent reporting build confidence with buyers and lenders.

- Operational efficiency: Demonstrating margin resilience and scalability shows that your business can perform even in higher cost-of-capital environments.

- Growth story: Buyers pay premiums for businesses with clear pathways to expansion, whether through same-store improvements, geographic growth, or service diversification.

- Management depth: A strong leadership team signals continuity, reduces perceived risk, and supports long-term value creation.

- Compliance and risk management: Addressing regulatory, legal, and contractual issues upfront helps avoid surprises during diligence.

The lesson from 2020-2022 is that cheap capital fueled aggressive deal-making. The lesson from 2023-2024 is that rising SOFR exposed weaknesses in unprepared businesses. The opportunity in 2026 will belong to those who have learned from both cycles and are ready to engage strategically.

At Polaris Healthcare Partners, our message remains consistent: prepare your business now, engage early, and position for maximum value. The next wave of M&A is coming and those who are prepared will be best positioned to ride it to success.

Contact us to learn how we can help you build your legacy!